Highlights of the New Tax Reform Law

On December 20, 2017, Congress passed a comprehensive tax reform bill, the 2017 Tax Cuts and Jobs Act (TCJA), which President Trump signed into law two days later. It was effective on January 1, 2018 and will automatically expire on December 31, 2025. After that date, the rules for individuals revert back to the pre-existing tax code unless Congress enacts a new law.

The TCJA implements the most significant changes to the tax code in over 30 years. Whether the tax reductions encompassed by the TCJA lower your tax liability will depend upon whether you itemize deductions, and if you do itemize, what deductions you claim.

Certain provisions are beneficial to only some taxpayers. The standard deduction has increased. For individuals it was $6,350.00 under the old tax code and it is now $12,000.00. For couples filing jointly, the standard deduction has increased from $12,700.00 to $24,000.00. Medical expenses could previously be deducted only if they exceeded 10% of adjusted gross income. Now they will be deductible to the extent that they exceed 7.5% of adjusted gross income — but only for tax years 2017 and 2018. Deductions for cash contributions to charities are increased from 50% to 60% of adjusted gross income.

The child tax credit has been increased from $1,000.00 to $2,000.00 ($1,400.00 of which is a refundable tax credit). Whereas distributions from a 529 plan could previously only be used for expenses relating to higher education (post-secondary), up to $10,000.00 per student can be withdrawn per year to pay for tuition at an elementary or secondary public, private or religious school.

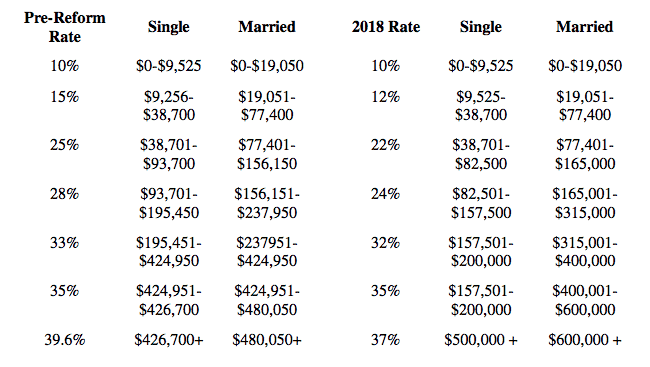

Individual tax brackets have been reduced as follows:

There are other provisions of the TCJA which are not beneficial to taxpayers. The TCJA imposes a new limit on the deduction for state and local taxes. Taxpayers can deduct an annual total of up to $10,000 on property, state and local income tax and sales tax. The mortgage interest deduction on primary and secondary residences is reduced and applies only to loans under $375,000 for single taxpayers and $750,000 for married couples filing jointly. Formerly, these amounts were $500,000 for single tax payers and $1,000,000 for married couples filing jointly. Under the TCJA, the deduction only applies to debt incurred to for the purchase, construction or substantial improvement of the home. Thus, interest on a mortgage obtained for debt consolidation would not be deductible. Interest on home equity loans and home equity lines of credit is no longer deductible.

The current personal exemption of $4,050 is eliminated. All miscellaneous itemized deductions, which had previously been subject to the 2% floor, such as investment management fees, tax preparation fees, safe deposit fees and union dues, have been suspended under the TCJA. Moving expenses will now only be deductible for those on active military duty and subject to a military order.

Interestingly, alimony, or “maintenance” as it is referred to in New York, will no longer be deductible by the payor or taxable to the recipient for those who sign divorce or separation agreements after December 31, 2018.

Insurance losses are affected. The theft loss deduction and personal casualty loss deduction are eliminated with an exception for losses incurred in federally declared disaster areas. The tax on long-term capital gains is unchanged and the exclusion of gain from the sale of a principal residence, which has been occupied by the owners for 2 of the last 5 years, remains at $250,000, $500,00 for married couples filing jointly.

Your accountant can help you evaluate the impact that the new law has on your federal income tax liability. If you do not have an accountant and would like to speak with one, call Berwitz & DiTata LLP and we will refer you to an accountant who can help you.

In the realm of estate taxes, the federal estate tax exemption is doubled to $11.2 million for a single decedent and $22.4 million for couples and inheritors will continue to receive the benefit of a “step-up in basis” to date of death value. However, in 2026 the increased exemptions revert back to the levels available prior to the TCJA in 2026.

The significant increase in the exemption from federal estate tax liability is unquestionably beneficial as it eliminates federal estate tax liability on the first $11.2 million dollars of a single person’s estate or up to $22.4 million of the estate of a a married couple, provided their estate plans have incorporated proper tax planning. Unfortunately, there has been no comparable change enacted by the New York State Legislature. Consequently, estates of single individuals with assets worth in excess of $5.4 million dollars and estates of couples worth more than $10.8 million dollars may still be subject to New York State estate tax liability.

Even more troubling is the fact that unaware individuals may be mislead into believing that, because the estate tax liability has been significantly reduced, it is unnecessary to have their estate plans reviewed. Failing to properly plan, or to adjust the plans that are in place, may have a severe impact not only on the assets available during lifetime but also on the wealth that is passed to beneficiaries. At Berwitz & DiTata LLP, we offer a complementary estate planning review to existing clients every three years after we have assisted them in implementing their plans. For new clients, the consultation fee is a small price to pay to start the process of ensuring that your plan works, that it takes advantage of the new tax laws and that you will finally achieve the peace of mind that comes from knowing that you have properly protected your loved ones. After all, if you are not ready now, when will you be ready? How much more of an incentive do you need? Just what are you waiting for?