Social Security: Being Smart With Your Money

Most of us like to be smart about our money. Understanding how monthly Social Security benefits are paid is important to ensuring that we make the most of this guaranteed lifetime income.

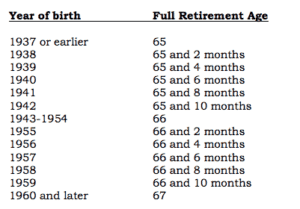

One of the most important decisions that we make about Social Security is when to start receiving benefits. You can start receiving benefits as early as age 62. Your full retirement age (FRA) is the time at which you may begin drawing your full payment. Full retirement age depends on the year you were born. Please see the chart below to find your FRA.

If you choose to take Social Security benefits after age 62 but before your FRA, the amount you receive will be reduced. If you begin to take benefits after your FRA, the monthly benefit will be increased. Generally, the longer you wait to begin receiving your Social Security benefits, the higher your monthly payments will be.

Comprehensive planning should be undertaken before making the decision as to the onset of your Social Security benefits. An examination of your expenses and other sources of income, such as pensions, annuities, investment income and inheritance is a good place to start. While delaying the onset of benefits results in an increase in your monthly income stream later in life, it means you will have less money earlier in your retirement. Thus, for instance, if you retire with fewer assets, their growth potential is lower, the income you will earn on them is less, and your expenses may be hard to meet. In that scenario, waiting to begin taking Social Security benefits until age 70, for example, may not be optimal: you may need the cash flow earlier.

Married couples have additional strategies available to them. For example, you can claim benefits based on either your own earnings or your spouse’s. You can even qualify to receive benefits if you have little or no work history! If you claim your spouse’s benefits, you will receive 50% of what your spouse is entitled to receive if you wait until your full retirement age. If you opt to receive benefits before FRA, the amount will be reduced.

Another strategy for married couples to consider is to “suspend” Social Security payments. It is referred to as the “claim and suspend” strategy. This strategy can only be implemented when the suspending spouse has reached his or her FRA. It is recommended when (1) the higher-earning spouse wants to continue working and the lower-earning spouse wants to retire and (2) the higher-earning spouse’s benefit is significantly higher than the lower-earning spouse’s benefit, so much so that the lower-earner would be better off receiving 50% of the higher earner’s benefit than the benefit calculated on his or her own work history. Here’s how it works: the higherearner files for benefits and suspends them until a later date. As long as the lowerearner has attained age 62, he or she can start receiving benefits based on the higherearner’s work history, and the higher-earner’s future benefits will continue to increase work life.

Another way for couples to enhance benefits is for the higher-earner to initially claim spousal benefits of the lower earner, and allow his or her own benefits to grow, and then switch to their own benefits later in life. This is a good strategy for couples who can handle lower income benefits at the beginning of their retirement and look forward to higher payments later. The “claim and suspend” strategy described above works best when the couple has very different work histories. This one is best for the couple whose lower-earning spouse would not be better off with 50% of the higherearner’s benefit – their Social Security benefits are less disparate. It should also be considered if the lower-earner expects to outlive his or her spouse. here’s how it works: once the higher-earner has reached FRA and the lower earner is at least 62, the higher earner claims the spousal benefit of 50% of what the lower-earner’s full benefit at FRA will be. The higher-earner receives 50% of the lower earner’s benefit as if he or she had already reached FRA. The lower-earner gets his or her reduced benefit at age 62. After a few years, when the higher earner’s monthly benefits have grown, the higher-earner can begin receiving his or her own benefit, increasing the couple’s combined monthly benefit thereafter until the higher earner’s death, and even beyond, read on.

After the death of one spouse, the survivor is entitled to receive the higher of the two benefits. This is called the survivor’s benefit. Thus, if you die, your spouse can claim your full monthly amount if it is higher than his or her own. naturally, the monthly amount of the survivor’s benefit will be lower if either the first-to-die elected to receive benefits before he or she reached FRA or the survivor begins to receive the benefit before reaching FRA. This is something for couples to consider: if you commence receiving benefits before your FRA, you are permanently limiting your spouse’s survivor’s benefit. Delaying your claim means your benefit will grow and your surviving spouse will have extra financial protection upon your death. This is a strategy you may wish to employ if your monthly Social Security benefit at full retirement age is higher than your spouse’s and your spouse is in good health and expects to outlive you. How about working while receiving Social Security benefits? If you work and are beyond FRA, you can receive your benefits without any reduction. If you work and claim your benefits before reaching FRA, your benefits will be reduced. When you are younger than your FRA, your Social Security benefits will be reduced by $1 for every $2 you earn over $14,160. The year you reach FRA, the benefits will be reduced by $1 for every $3 you earn over $37,680. These strategies can help maximize your Social Security benefits and should be part of your overall retirement planning.

Call Berwitz & DiTata LLP if you have questions about this or other retirement planning strategies.