FDIC Update

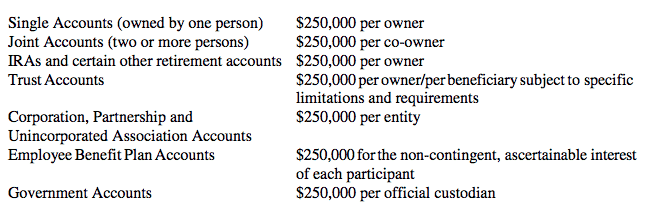

The lead article in the most recent issue of our newsletter reviewed FDIC limitations. The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the U.S. government that protects against the loss of deposits if an FDIC-insured bank or savings association fails. We were not the only ones who were concerned about the stability of our financial institutions in these tough economic times. As part of the recent legislative enactments, the “government bail-out,” FDIC limits have been increased, effective October 3, 2008 through December 31, 2009, as follows:

These refer to the total of all deposits that the accountholder(s) has at each FDIC-insured bank, assuming that all FDIC requirements are met.

FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). FDIC insurance does not cover other financial products and services that insured banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities.